As parents, we can’t help but worry about our children’s education and future. That’s why some of us started saving for our kids from the day they were born.

The obvious choice for most is a junior savings account. This refers to special bank products that are aimed at savers below the age of 18. These accounts enjoy higher interest rates, some as high as fixed deposit (FD) rates, but unlike FD you can still withdraw from these junior savings accounts.

That said, not all junior savings are created equal.

After a few parents started a discussion about which bank offers the best junior savings, I went through all the pros and cons, benefits and conditions of kids savings bank accounts offered by 10 different banks.

What started out as a fact-finding mission just to answer a few questions turned into a full-fledged research project. So if you’re looking for an answer to the question, “Which is the best bank for my children to open a savings account?”, this is the post for you.

What To Look Out For

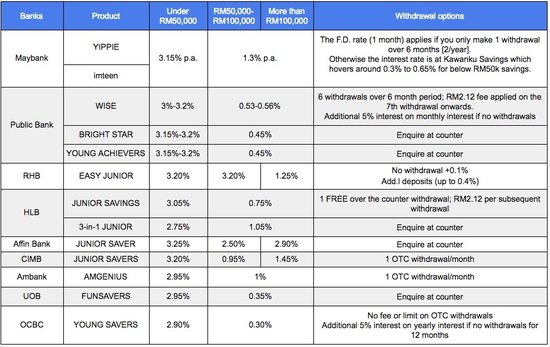

If you are looking for the interest rates for comparison, I have grouped them all together in a table for easy viewing.

There are 13 products from 9 banks listed. I chose these due to their competitive rates. There are other banks out there but putting them into this table makes the comparison a bit lopsided.

You will be able to see info such as age eligibility, initial deposit required as well as the multi-tiered rates that are dependent on the balance in the account.

Note! These are the rates that turn up during the research for this article. By the time you read this, it is possible that the figures have been changed by the banks. Before you make any financial decisions, please take the time to check with your bank for their most updated and current rates.

Table 1 Interest rates of Junior Savings Bank Accounts

If you don’t already know, regular savings bank accounts have pitiful interest rates, hovering around 0.3 to 0.6% at best.

As you can see in Table 1, junior savings bank accounts offer 10 times the interest rate of their adult counterparts. If you’re not under the age of 18, the only way you can see those rates is if you put your money in FD, or if you put in a large amount.

If you are below the age of 18, most of these banks (bar 2 exceptions) are available to you. Some require as little as RM1 as an initial deposit; the highest amount is RM500 for OCBC Young Savers.

The age requirement is something important to take note of a good 10, 15 years from now, Because the moment the account holder turns 18, their junior savings account will be converted into conventional savings and their interest rates will drop to measly figures.

As a reminder, interest rates will change from bank to bank and they may even change more than once a year per bank.

What You Need To Know: Interest rates may come with conditions

If you grab a pamphlet from the counter in any bank, you will probably see the interest rate figures printed in large fonts, and if you aren’t paying attention, you’ll probably miss out on the conditions you have to fulfill in order to “earn” those rates.

The savings amount and withdrawal options both play important roles in helping one decide the right savings account for their children. Check out the table to find out why.

Table 2 How to keep or earn the Interest rates they print on the pamphlet

* Watch out for the link to the comprehensive combined comparison chart in our next post

What To Consider: The amount of savings

As you can see, the interest rates I’ve listed here are broken down into 3 columns, for savings of less than RM50,000, for savings between RM50,000 and RM100,000 and for savings beyond RM100,000.

Notice how interest rates across the board, drop tremendously past the RM50,000 mark.

If you save diligently, do it almost entirely online and thus do not update your passbook on a yearly basis, there is a possibility that one day down the line you breach the RM50,000 limit without knowing.

When that happens, you’re seeing interest that can buy you a brand new PS4 drop down to clearing one month’s electricity bill.

In this scenario, you won’t be affected much if you bank with RHB Easy Junior because it still gives you 3.2% up to RM100,000.

Affin Bank Junior Saver also gives you a relatively healthy 2.5% compared to Maybank Yippie’s 1.3%, Ambank AmGenius and HLB 3-in-1 Junior (around 1%).

The other banks drop it down to regular conventional savings rates, post-RM50,000.

If you want to ensure that you are saving effectively for your children, you need to stay on top of your all your savings and investments constantly.

What To Consider: Withdrawal conditions that affect interest rates

Now I know that parents use these banks for savings purposes, but eventually down the road when their teenagers begin learning how to better manage their money, it’s possible that they need to make periodical withdrawals from “their” accounts.

Here’s where withdrawal conditions may mess up your interest rate privileges.

For Maybank’s Yippie, you only get the 3.15% per annum if you make a single withdrawal across 6 months. That’s (2) withdrawals in a year, 6 months apart.

So if you make (3) withdrawals in a year, you are not getting your 3.15% p.a. interest rate. The same thing happens if you make two withdrawals less than 6 months apart.

If you have to make monthly withdrawals from your kid’s account, this product is not for you.

What about the other banks then? Public Bank WISE is much wiser. It gives you 6 withdrawals over a 6 month period (an average of once per month) and even if you exceed that, it just charges you a RM2.12 fee per withdrawal.

Withdrawing from this account doesn’t harm your interest rate but remember that exceeding RM50,000 does: the rate drops to around 0.56%, which is a huge drop. In comparison, Maybank’s Yippie drops to 1.3%.

By the way, I have to mention that Public Bank WISE offers you an extra 5% interest on your monthly interest if you do not make any withdrawals. While that 5% sounds like a lot, do note that it is applied on your interest, not your capital. At most, this amount is no more than RM6.50 per month.

RHB Easy Junior also has a reward (instead of a penalty) for non-withdrawals, an additional 0.1% to their already high 3.2%. Plus, if you make regular monthly deposits they give you a bit more % p.a. i.e up to 0.4% if you bank in RM1000 every month.

So theoretically, if you bank in RM1000 per month into your RHB Easy Junior, and make no withdrawals for the whole year, you are enjoying 3.7% p.a

But that’s a lot of conditions to follow and with RM1000 savings per month (RM12,000 a year), you might get better returns from other investment options.

From Table 2, you can see that a few other bank products also offer 1 over-the-counter (OTC) free withdrawal every month, with no penalties that affect the interest rate. That said, this table of info is not exhaustive. Do make your enquiries at the bank of your choice for more details.

Wrapping Up Part 1

Alright, that’s enough info to keep you busy for the moment.But if you want more, keep an eye out for our follow up post where we look at how bad dormant accounts cut back on your earnings as well as some of the benefits offered by these junior savings accounts that might be the deal-breaker you need.

Also, we pit these junior savings accounts against their Fixed Deposit counterparts to see which is the real deal you should be banking on.

To be continued..... Part 2 here

.png)

.jpg)

.png)